Our Expertise in Sanctions Law & Compliance

- Sanctions Designation & Delisting – Challenging unlawful designations and restoring financial access.

- Sanctions Exemptions & Licences – Obtaining authorisation for transactions involving sanctioned entities.

- Financial & Trade Sanctions Compliance – Assessing risk and ensuring compliance with UK, EU, US, and UN sanctions regimes.

- Frozen Assets & Bank Account Restrictions – Assisting in securing access to frozen funds and lifting injunctions.

- Cross-Border Transactions & Export Controls – Advising businesses on legally conducting international trade.

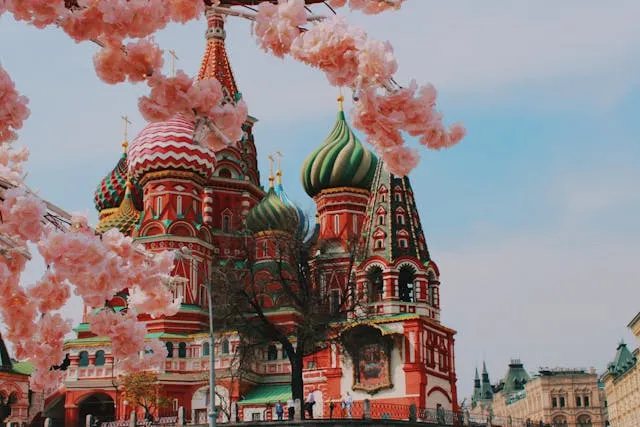

- Russia & Ukraine-Related Sanctions – Providing guidance on the Russia (Sanctions) (EU Exit) Regulations 2019 and related measures.

-

+447903733137

-

+4402038755629

-

+442039728469

International Sanctions Representation

Our London-based sanctions solicitors have extensive experience in handling high-stakes sanctions matters, including:

- Assisting businesses and individuals in challenging their inclusion on international sanctions lists.

- Defending clients facing penalties or criminal prosecution for alleged sanctions violations.

- Negotiating with authorities such as the UK’s OFSI, US OFAC, and the European Commission.

- Advising on risk assessments and due diligence for multinational companies.

With multi-jurisdictional expertise and a network of trusted partner law firms worldwide, we provide highly practical and results-focused legal solutions for clients operating in complex regulatory environments.

UK Sanctions Regime & Compliance Obligations

Following Brexit, the UK implemented its own independent sanctions framework through the Sanctions and Anti-Money Laundering Act 2018 (SAMLA 2018). This allows the UK government to impose targeted restrictions, including:

- Financial sanctions – Freezing assets and restricting access to banking and financial services.

- Trade sanctions – Prohibiting the sale, supply, and export of certain goods and services.

- Investment bans – Preventing UK entities from engaging in economic activities with sanctioned individuals or businesses.

Non-compliance with these regulations is a strict liability offence under the Policing and Crime Act 2017, meaning businesses and individuals can face penalties of up to £1 million or 50% of the transaction value.

Why Choose Eldwick Law for Sanctions Legal Advice?

- Specialist expertise – One of the few UK firms focused on high-profile sanctions cases.

- Proven track record – Successfully advising businesses, financial institutions, and individuals.

- Strategic global perspective – Extensive experience across UK, US, EU, and UN sanctions regimes.

- Rapid response legal support – Immediate assistance in securing exemptions and mitigating penalties.

FAQs on Sanctions Law & Compliance

Can I be removed from a sanctions list?

Yes, sanctions designation can be challenged. Our lawyers have successfully represented clients in delisting applications before the UK government, EU Council, US OFAC, and UN Security Council. The process involves filing formal appeals, providing supporting evidence, and engaging with regulatory bodies.

What happens if my assets or accounts are frozen?

If your bank accounts or assets have been frozen due to sanctions, you cannot:

- Access, sell, or transfer your funds.

- Receive payments from others.

- Engage in financial transactions that bypass sanctions restrictions.

Our team will act swiftly and decisively to challenge the restrictions and, where appropriate, apply for an OFSI or OFAC licence to release frozen funds.

Contact Our Leading Sanctions Solicitors in London

If you have been designated on a UK, EU, US, or UN sanctions list or need expert legal advice regarding sanctions compliance and risk management, our specialist team is ready to assist.

Related Articles:

- Obtaining an OFSI licence

- How Sanctions Are Increasing Risks for Indian Businesses

- Barclays Bank v VEB.RF, Key Insights on Russian Sanctions

- How Sanctions Against Russia Affect the Insolvency Process in the UK